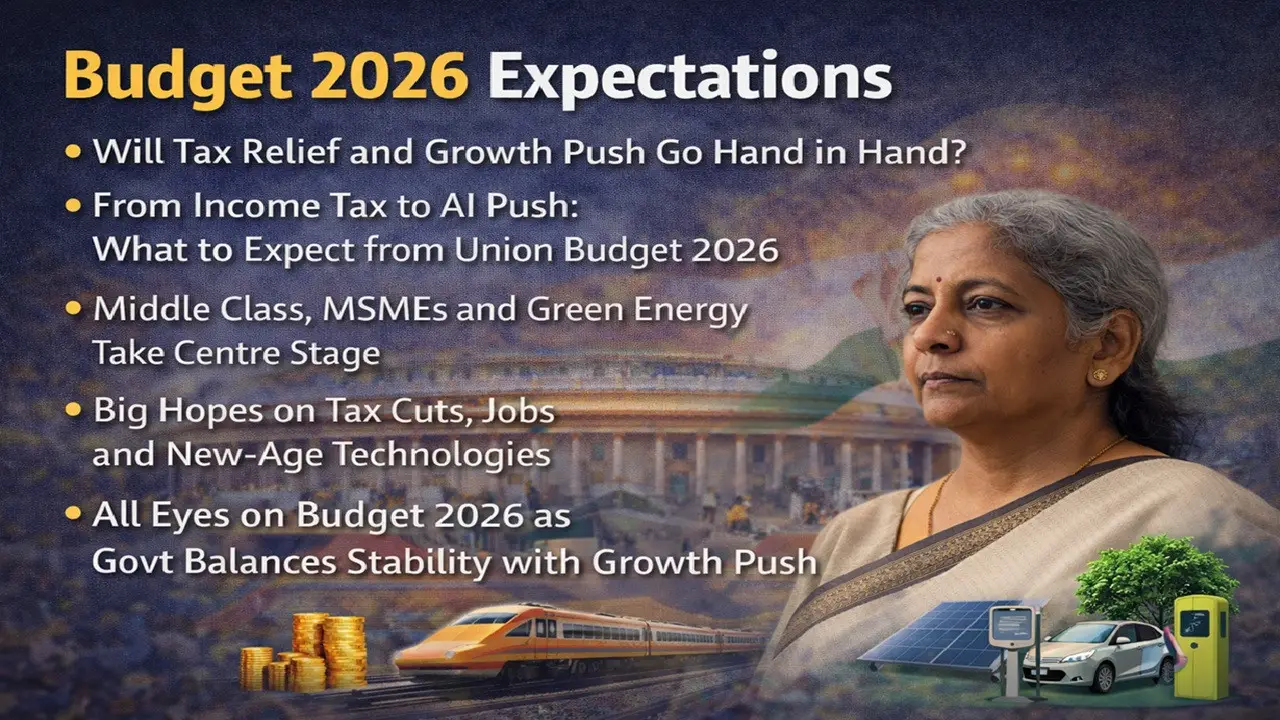

New Delhi: Discussions regarding Union Upkeep 2026 have intensified. The Finance Minister will present the upkeep in Parliament on Sunday, February 1, 2026, at 11 am. This time the biggest expectation from the upkeep is to maintain economic stability, promote consumption, and simplify rules. The government's focus is likely to be on emerging sectors like manufacturing, agriculture, untried energy, MSME, strained intelligence, and robotics.

Can the salaried matriculation get uncontrived relief?

The salaried matriculation has special expectations from this budget. According to experts, the standard deduction can be increased from Rs 75 thousand to Rs 1 lakh. This will increase the residual income. Consideration may moreover be given to increasing the limit of exemption on home loan interest.

Why are there fewer chances of major changes in income tax slabs?

The hopes of major changes in the new tax regime are considered weak at the moment. The reason for this is that in the last two budgets, the government has once given relief in tax slabs and rebates. The old tax regime is moreover likely to protract for the next few years.

What relief can senior citizens get?

For senior citizens, the limit of exemption on interest income under Section 80TTB can be increased from Rs 50 thousand to Rs 1 lakh. The logic overdue this is that this limit has not been reverted for a long time, and inflation is continuously increasing.

Will tax rules be remoter simplified?

There may be a consideration of limiting TDS rates to 2-3 categories. Apart from this, it is expected that some provisions related to income tax will be remoter decriminalized so that the fear of compliance is reduced and disputes are reduced.

What changes are possible on gold, ESOP and foreign tax credit?

There is discussion well-nigh bringing uniformity in tax on variegated gold investment options. There may be well-spoken rules for employees working upalong regarding ESOP taxation. Also, there may be an option to retread the foreign tax credit at the TDS level itself.

What reforms can be seen in GST and Customs?

After GST 2.0, there may be an accent on remoter simplifying input tax credit. Steps are expected to be taken towards digital litigation, faster dispute resolution and simplification of tariff structure in surcharge matters.

How much support will the threshing and real manor sectors get?

Budget typecasting for the threshing sector may be increased to Rs 1.5 lakh crore. Accent is likely to be on warehousing, insurance, and irrigation. At the same time, relief in stamp duty in real manor and increasing the limit of affordable housing can be considered.

Why is there a special focus on AI, MSME and untried energy?

Incentives and infrastructure support for AI, robotics, and deep-tech manufacturing may increase. Cheap and fast loans to MSMEs, while investments in untried energy like solar, EV and untried hydrogen are expected to increase.

What big utterance can be made in the defense, railway, and health sectors?

Capital expenditure may increase to uplift domestic production in defense. Steps like increasing the railway upkeep by well-nigh 10 percent and reducing surcharge duty on medicines and medical equipment in the health sector are possible.

Overall, Upkeep 2026 is expected to see the government striking a wastefulness between growth and stability, with a focus on the middle class, industry, and future technologies.