Why Does Credit Matter So Much Anyway?

If you've ever applied for an apartment, car loan, or even some jobs, you know your credit score can follow you everywhere. It's like your financial report card. A lousy score can slam a lot of doors in your face, no matter how hard you're working now. If your credit is trashed, rebuilding it feels overwhelming. But here's the good newsrebuild credit doesn't have to take forever, and you don't need piles of cash to get started.

Can You Really Rebuild Credit Instantly?

Let's be real: you won't wake up tomorrow with a perfect credit score, no matter what those flashy ads promise. Real results happen in weeks, not years. The speed depends on what hurt your score in the first place. Missed payments? Maxed credit cards? Identity theft? You can improve credit score with fixes that work. It's all about knowing where to start and where mistakes happen.

First Step: Check What's Hurting Your Score

Pulled your credit report lately? Most people haven't. That's the first move. You're allowed free copies each year. Look for errors, late payments, and accounts you don't recognize. Speak up if something's wrongdisputing a mistake can give your score a quick boost. Think of this as checking your house for leaks before fixing anything else.

- Review your credit reports from all three bureaus

- Highlight anything that looks wrong

- Start a dispute for mistakes or fraud

How To Fix Bad Credit Starting This Week

Now, on to the real work. Good habits make the biggest difference over time, but some actions help nearly overnight. Want to fix bad credit fast? Start with these moves:

- Pay bills on time from today forward (set reminders on your phone)

- Pay down high credit card balances if you can (even $50 helps)

- Ask your credit card company for a limit increase (don't spend it, though)

- Become an authorized user on a family member's good credit card

- Avoid opening a bunch of new accounts at once

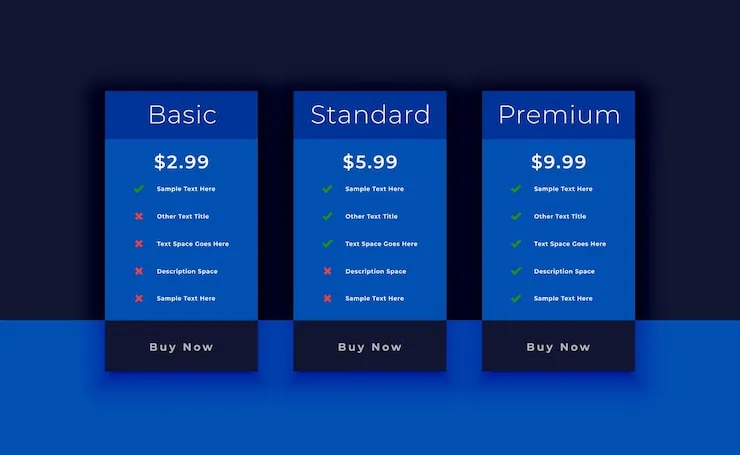

Credit Repair: What's Legit and What's a Scam?

There's a whole industry promising to boost credit in a flash. Most charge big fees to do stuff you can do yourself. If anyone says they can erase negative info that's accurate, run away. The legit path? Do the basics: dispute errors, pay bills, watch your spending. It's not fast money, but it's real. Trying to game the system usually backfires.

Quick Wins That Actually Work

Everyone wants a shortcut. A few things can speed up your credit recovery. They're not magic, but they help:

- Try a secured credit card (you put down a deposit, use it wisely, and payment history gets reported)

- Sign up for credit-builder loans (these are small and help you look responsible)

- Set up autopay on every bill to avoid future late marks

Remember, a little momentum goes a long way. One success leads to another, and soon, lenders start to trust you again.

Common Mistakes That Make Credit Worse

It's easy to panic and make things worse. Here are a few things to avoid:

- Closing old credit cards (older accounts help your score, use them now and then if you can)

- Paying for fake 'quick fix' services

- Maxing out your credit cards again after payoff

- Skipping payments because 'it can't get worse' (it can)

How Long Does It Take To See Real Results?

You'll see small wins in a few weeks if you're consistent. Big changes can take months, sometimes a year or more, especially if you have collections or bankruptcies. But you should notice a bump from simple fixes. Think of it as building muscleyou won't look like an athlete after one workout, but you'll feel the difference after sticking with it for a month.

What To Do When Nothing Seems To Work

If you're stuck, don't quit. Sometimes you need a fresh pair of eyes. A nonprofit credit counselor can help spot problems and help you with a planwithout selling you expensive 'solutions.' Ask someone you trust to look at your budget, too. Getting out from under debt is hard, but doable.

Staying Motivated When Credit Recovery Feels Slow

Bad credit can make you feel like you're carrying a weight around. Set small goals, like paying off $100 this month or keeping your payment streak alive. Reward yourself for progress. Keep reminders of why you want to get your score upbetter apartment, lower car payment, less money stress. Every step forward counts.

FAQ

- How fast can you rebuild credit from bad to good?

If you're starting from scratch, you might see improvements in your score within 30-60 days by making payments on time and reducing debts. For a big jump, it usually takes 6-12 months of steady effort. Fast fixes are possible, but real change is a bit of a waiting game. - What's the best way to improve credit score if I have no credit history?

Start with a secured credit card or a credit-builder loan. These are made for people with no credit. Make all your payments on time and keep your balances low. In a few months, you'll start to see a score build up. - Can credit repair companies actually boost credit quickly?

Most can't do anything you can't do on your own. Some will try to clean up errors, which you can do yourself for free. If a company promises to erase real debts or 'guarantee' huge jumps overnight, it's not legit. - Will paying off collections help fix bad credit?

Paying off collections won't erase them from your history right away, but it does matter. With some newer scoring models, a paid collection hurts less. Do your best to pay it off and ask for a letter to show it's settledit helps in the long run. - How much does credit utilization affect my credit score?

A lot. Using more than about 30% of your available credit can drag your score down, even if you're making payments. Try to keep your balances low. Even paying off small amounts can give your score a quick lift. - Is it bad to check my own credit report too often?

Nope. Looking at your own score or pulling your own report is called a 'soft inquiry' and doesn't hurt your credit one bit. In fact, it's smart to check regularly for mistakes or signs of fraud.

Rebuilding credit really is a journeynot a sprint. Start small, keep going, and you'll see proof that things can get better in just a few weeks. Stay patient. You've got this.