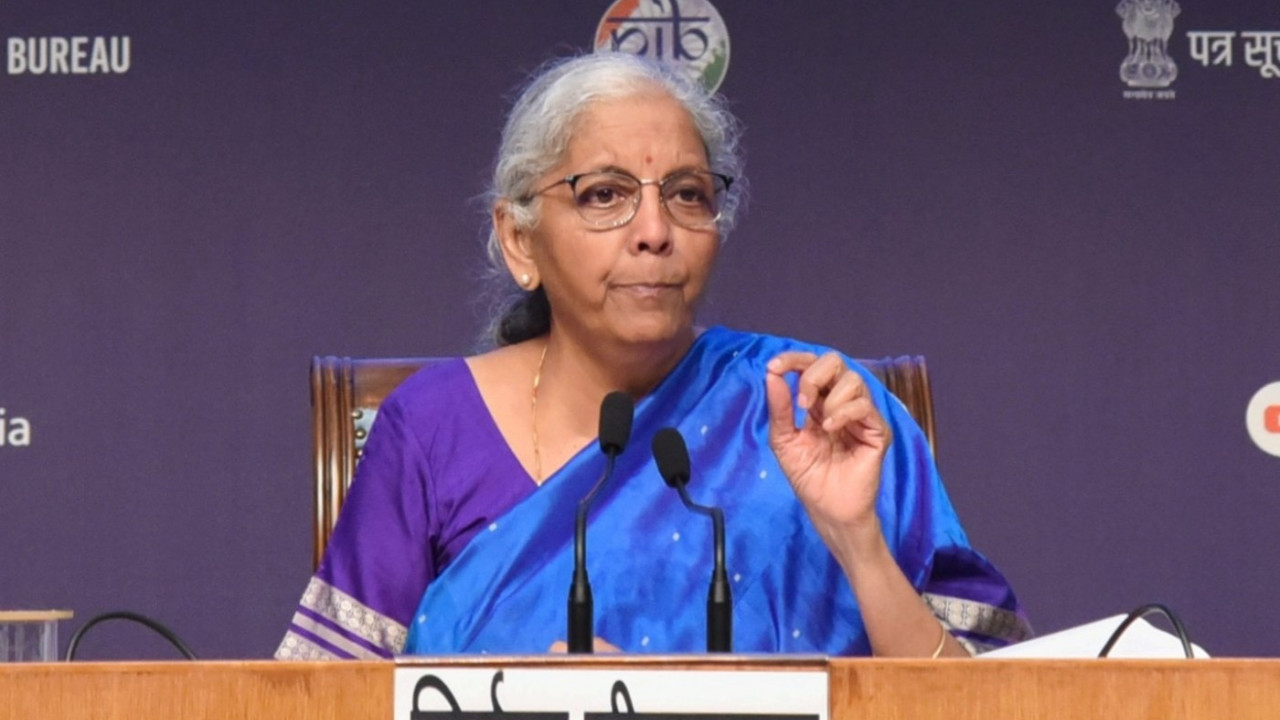

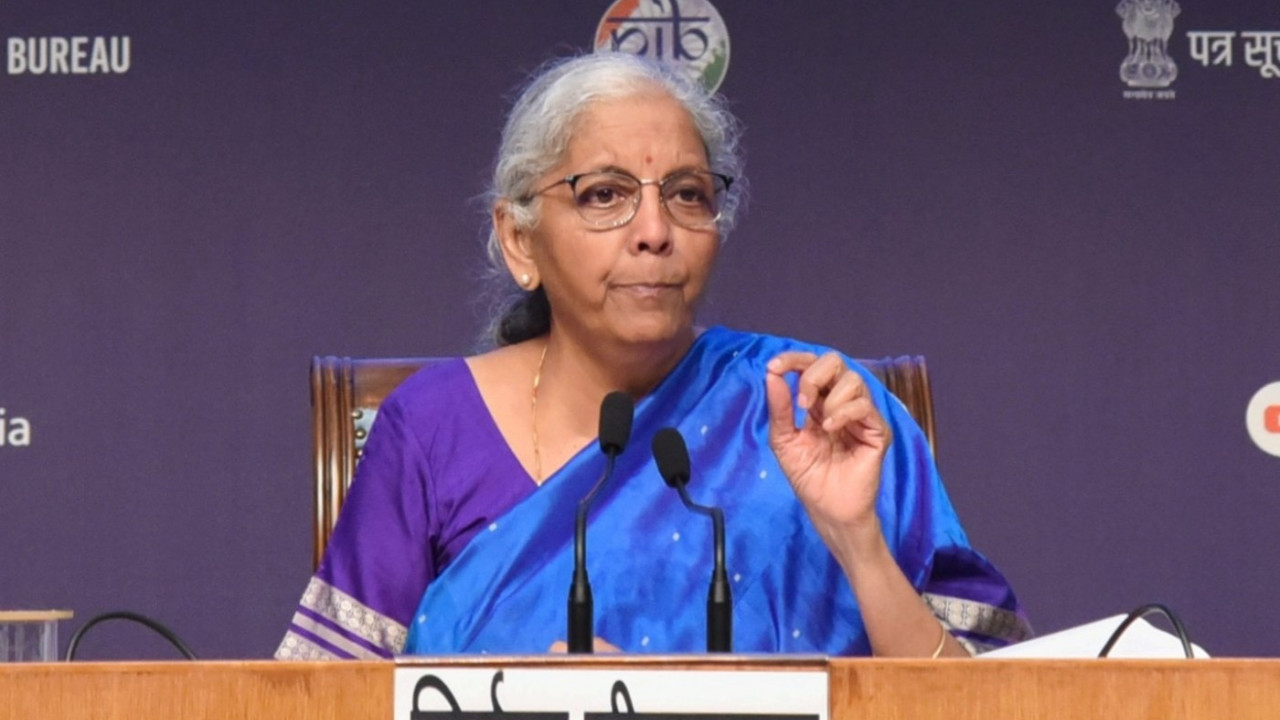

New Delhi: Union Finance Minister Nirmala Sitharaman on February 1 will present the Union Upkeep 2026 in the Parliament. With just days to go surpassing the Union Budget, expectations among middle-class and salaried taxpayers are running high.

With this Nirmala Sitharaman will wilt the first finance minister of the country to present the unstipulated upkeep nine subsequent times.

Here is a list of the key wishes of the taxpayers:

How will One Nation- One Income Tax Return (ITR) Form help taxpayers?

The One Nation, One Income Tax Return Form is an initiative by the Income tax department to simplify filing. The aim is to merge multiple existing forms into a single customized ITR, except for ITR 7.

There are currently seven ITR forms, which are workable to variegated categories of taxpayers. These multiple forms often misplace taxpayers and by creating complexity increase the chances of errors.

The taxpayers struggle every year to icon out the correct ITR form workable for them on the understructure of their income and other parameters of that year

What is Master Circular for New Act?

The new Income-tax act would wilt workable from April 1, 2026.The pupose of this is to consolidate numerous circulars and notifications which have been issued in the past six decades in the context of the Income-tax Act, 1961 (old Act).

What is Tax deduction at Source (TDS) Reforms?

TDS compliances take a lot of time and there is an urgent need to revamp the TDS framework; and it may be possible to do that in a neutral revenue manner.

Last year, these reforms were designed to simplify compliance, reduce the undersong on small taxpayers, and modernize mazuma spritz by increasing thresholds and streamlining rates.

Another key expectation is clarity between the old and new tax regimes. While the new regime offers lower tax rates, it removes most exemptions and deductions.

Taxpayers want either largest incentives under the new system or a simpler structure that does not gravity them to summate taxes twice surpassing making a choice. Some are hoping for increasingly deductions to be unliable under the new regime to make it truly attractive.

Homebuyers are once then looking at Upkeep 2026 with hope. There is demand for higher deductions on home loan interest and principal repayment, expressly as property prices and EMIs remain high.

Long-term savers are moreover watching closely. Many want higher limits for investments under tax-saving sections, arguing that the current caps discourage disciplined saving.