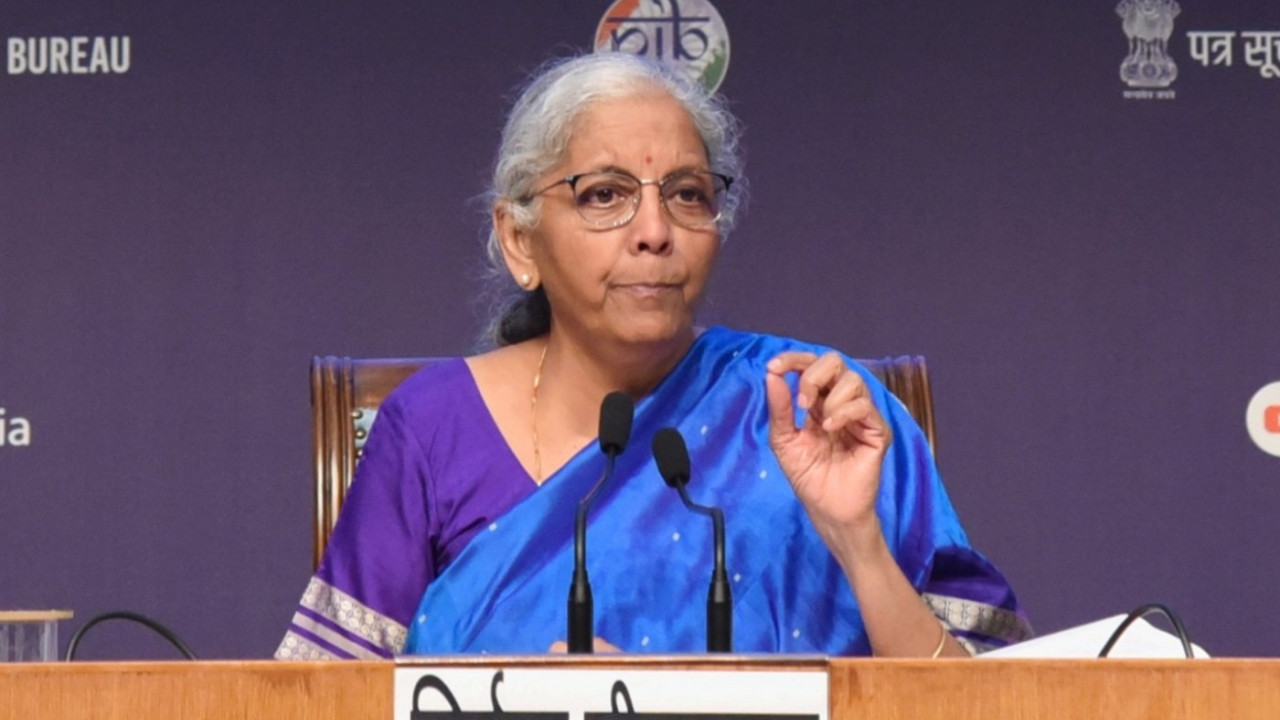

New Delhi: India's Union Upkeep 2026 has been presented. In her third upkeep speech under Modi 3.0 and the ninth of her tenure, Finance Minister Nirmala Sitharaman made several major announcements. These included a reduction in surcharge duties, which will lower the prices of many goods, as well as the utterance of 7 high-speed rail corridors and 1000 clinical trial sites. The government moreover emphasized its focus on the prosperity of farmers. Let's squint at 10 key takeaways from the upkeep and understand what variegated sections of society, from the middle matriculation to farmers, have gained from it.

What did the middle matriculation get from the budget?

In the third upkeep of Modi 3.0, there were no announcements regarding tax-related expectations. People had hoped that the standard deduction limit would be increased from Rs 75,000 to Rs 1 lakh, but this did not happen. Thus, the middle matriculation received no uncontrived benefits. However, some announcements do towards to goody them. This includes the exemption of duties on essential medicines. The upkeep has eliminated surcharge duty on 17 medicines, including those for cancer and diabetes. Additionally, the reduction in surcharge duty on several products will make items used by the middle class, such as shoes, slippers, and smartphones, cheaper.

What well-nigh MSME Champions?

During her upkeep speech, Finance Minister Sitharaman spoken a large fund to promote micro, small, and medium enterprises (MSMEs). The government has allocated Rs 10,000 crore for the MSME Growth Fund, and the government's objective is to create champion MSMEs.

What were announcements for the Health and Medical Sector?

Budget 2026 focused on the health and medical sector. The Finance Minister spoken that the private sector will participate in 5 medical hubs, where AYUSH centers, diagnostic services, post-care, and rehabilitation centers will be developed, which will increase employment in the health sector. In addition, the export of high-quality Ayurvedic products will be promoted. A bio-pharma scheme was moreover announced.

What's special for farmers?

Finance Minister Nirmala Sitharaman moreover made major announcements for farmers and the threshing sector in her speech. A credit-linked subsidy program will be launched to increase employment in the unprepossessing husbandry sector. Dairy, poultry, and livestock businesses will be modernized, and farmer organizations will be promoted through value uniting development. A Coconut Incentive Scheme will support high-value crops like coconut and sandalwood, benefiting 1 crore farmers and 3 crore people. Meanwhile, an ‘AI Agri Tool’ will help farmers increase productivity and make largest decisions.

What's in it for the armed forces?

The upkeep allocates 7.8 lakh crore to the Ministry of Defence for the financial year 2026-27. This reflects the government's focus on modernizing the armed forces. A provision of 2.19 lakh crore has been made for wanted expenditure for the defense forces. Last year, this icon was 1.80 lakh crore. Major announcements for the defense sector were once expected pursuit the success of Operation Sindoor.

What's in it for athletes?

The government has moreover focused on the sports sector in the budget, announcing plans to strengthen the Khelo India Mission for the next 10 years. Under this mission, training centers will be established, coaches and support staff will receive training, infrastructure will be developed, and national-level competitions and leagues will be organized. Additionally, duties on sports equipment have been reduced, making them increasingly affordable.

What did women get from the budget?

She-Marts have been spoken for rural women. To promote businesses led by such women, SHE (Self-Help Entrepreneur) Marts will be launched where women can hands sell their products. The Finance Minister moreover mentioned the success of the Lakhpati Didi scheme. In addition, hostels will be built for sexuality students in approximately 800 districts. The target is to build at least one hostel in every district.

Is there good news for students studying abroad?

A major utterance has been made in the upkeep regarding the expenses for medical treatment and education abroad. The government has reduced the interest rate on expenses under TCS (Tax Collected at Source) from 5% to 2%. This ways you will have to pay less interest if you spend your money abroad. However, this will only be workable to education and medical expenses. In simple terms, studying and receiving medical treatment upalong will now wilt cheaper.

Will Stock Market Investors benefit?

This upkeep has proven to be a shock for stock market investors as taxes have been increased again. The government has increased the Securities Transaction Tax (STT). STT was previously 0.1%, but it has now been increased to 0.15%. This had a devastating effect on the stock market, resulting in a crash and wiping out 8 lakh crore of investors' money.

Will the Manufacturing Sector get a India's Union Upkeep 2026 has been presented. In her third upkeep speech under Modi 3.0 and the ninth of her tenure, Finance Minister Nirmala Sitharaman made several major announcements. These included a reduction in surcharge duties, which will lower the prices of many goods, as well as the utterance of 7 high-speed rail corridors and 1000 clinical trial sites. The government moreover emphasized its focus on the prosperity of farmers. Let's squint at 10 key takeaways from the upkeep and understand what variegated sections of society, from the middle matriculation to farmers, have gained from it.

Will the Manufacturing Sector get a boost?

The upkeep speech showed a special focus on the manufacturing sector. An typecasting of 40,000 crore has been spoken for the EMS (Electronics Manufacturing Services) sector. This upkeep was 19,500 crore in the previous year's budget. Due to the doubling of the typecasting for the PLI (Production Linked Incentive) Scheme, the shares of EMS companies are showing strong activity.

The upkeep speech showed a special focus on the manufacturing sector. An typecasting of 40,000 crore has been spoken for the EMS (Electronics Manufacturing Services) sector. This upkeep was 19,500 crore in the previous year's budget. Due to the doubling of the typecasting for the PLI (Production Linked Incentive) Scheme, the shares of EMS companies are showing strong activity.