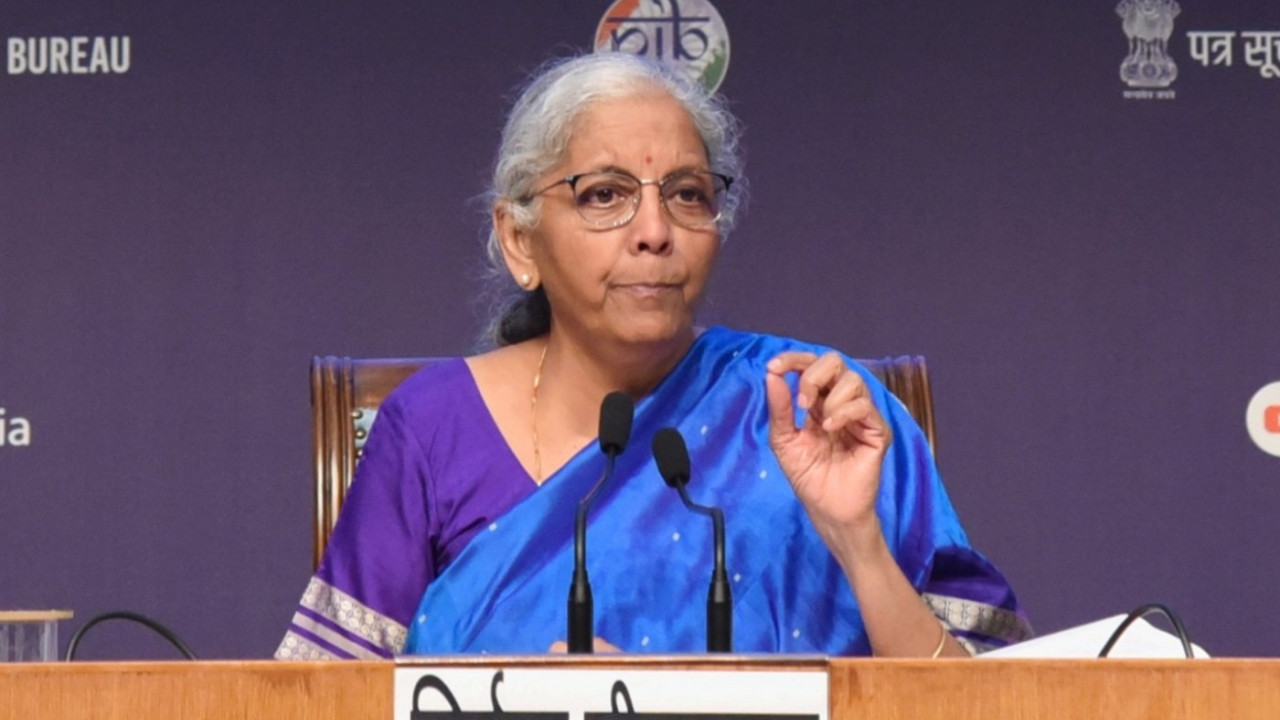

New Delhi: Importing goods from upalong will now be cheaper. The government has reduced surcharge duty. This was spoken by Finance Minister Nirmala Sitharaman while presenting the Union Budget 2026. She proposed reducing the surcharge duty on all imported goods from 20% to 10%. This ways that importing goods from upalong will now be increasingly affordable. The government aims to simplify the surcharge duty system.

Understanding how surcharge duty is levied can be a bit complicated. The Economic Times, based on information from the DHL website, explains that imported goods are subject to Basic Surcharge Duty (BCD). This duty depends on the type of goods. In addition, Integrated Goods and Services Tax (IGST) is moreover levied on the value of the goods and their HSN lawmaking (Harmonized System code). In India, goods are identified by an 8-digit HSN lawmaking based on their characteristics.

How is surcharge duty calculated?

Let's understand this using the method provided on the DHL website. First, the 'assessable value' is determined. This is calculated by combining the forfeit of the goods, insurance, and freight (CIF).

To prove this value, you must have all the necessary documents such as invoices and shipping bills.

After this, the Basic Surcharge Duty (BCD) is unromantic based on the HSN code.

Let's understand this in simpler terms:

Suppose you import an air conditioner worth Rs. 40,000 from abroad. The HSN lawmaking for the air conditioner is 84151020. Equal to the old rates, the numbering would be as follows:

Basic Surcharge Duty (BCD): 20% of 40,000 = 8,000

Integrated Goods and Services Tax (IGST): 28% of (40,000 8,000) = 13,440

Social Welfare Surcharge: 10% of (40,000 8,000 13,440) = 6,144

Total Duty and Taxes: 8,000 13,440 6,144 = 27,584

Thus, the total surcharge duty and taxes on this air conditioner amounted to 27,584.

Now, let's squint at the numbering equal to the new proposed rates:

Proposed Basic Surcharge Duty (BCD): 10% of 40,000 = 4,000

Integrated Goods and Services Tax (IGST): 28% of (40,000 4,000) = 12,320

Social Welfare Surcharge: 10% of (40,000 4,000 12,320) = 5,632

Total Duty and Taxes: 4,000 12,320 5,632 = 21,952

Therefore, equal to the new rates, the total surcharge duty and taxes will be 21,952.

How much will you be worldly-wise to save?

In this example, due to the reduction in surcharge duty on personal goods from 20% to 10%, there will be a saving of 27,584 - 21,952, i.e., 5,632. This will make importing goods from upalong cheaper for people. Note that this surcharge duty will not wield to gold and silver.